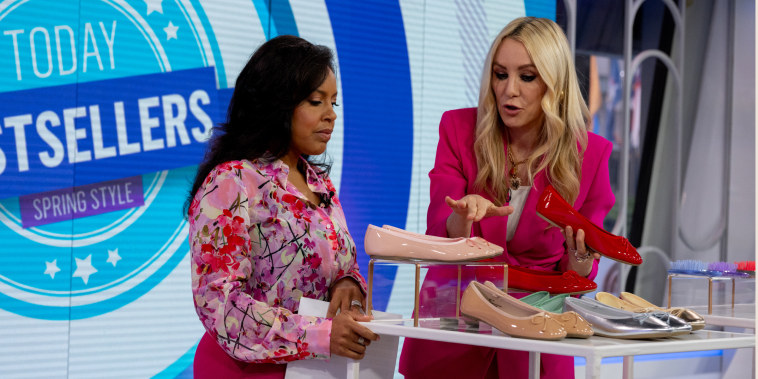

On the Show

Saw it on TODAY? Find recipes, resources, videos and more.

Saw it on TODAY

More from Shop TODAY

Our Most Saved Recipes

These are the recipes you're saving the most thanks to our new accounts experience!

Health & Wellness

Get health tips, read personal essays, weight-loss stories.

Food

The latest food trends, easy recipes and healthy meal ideas to help you cook smarter.

Food trends

Recipes from TODAY

Parents

Stories, trends and tips for every stage of parenthood... because we're all in this together

Life

Get the best inspiration, quotes, and holiday ideas from TODAY editors.

Astrology

Find your monthly horoscopes, astrological profiles of zodiac signs, and info about other spiritual practices.

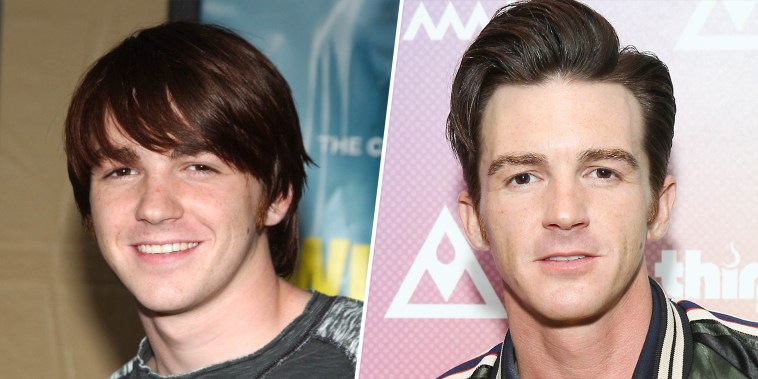

Pop Culture

Get entertainment and celebrity news and trending stories.

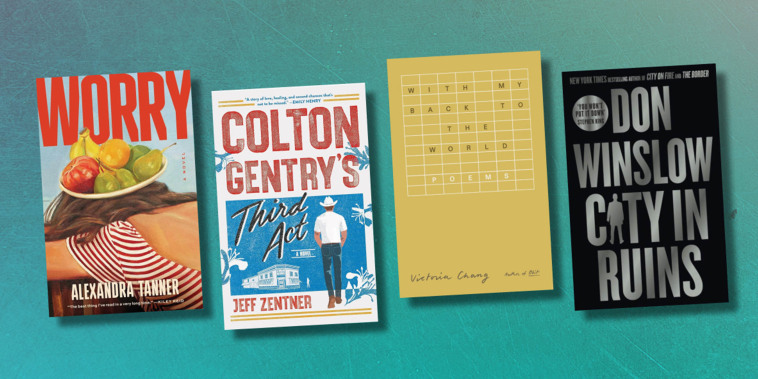

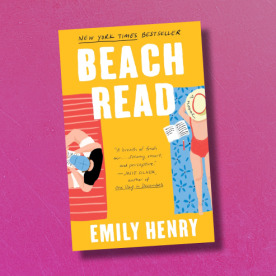

Books

Get TODAY's list of the best books to read, recommendations, excerpts and more

Read With Jenna

What to read next

Relationships

Find inspiring stories and expert advice on how to have a healthy relationship with yourself and others.